Filing 2023 Tax Form W-2 with state of Illinois

Easy-to-Use. Secured. File From Any Device

Get Started TodayPricing starts at $0.50/form

Illinois State Business Tax Extensions

Businesses must report their income and expenses to the state of Illinois.

If businesses need more time to prepare and file their state business income tax returns, they can extend the deadline for up to 6 months.

Illinois does not require any additional tax extension form to get a tax extension, an automatic extension of 6 months of time is granted by Illinois state. But if there are any tax dues, it must be paid within the deadline using Form IL-505-B.

Information About Illinois State Filings

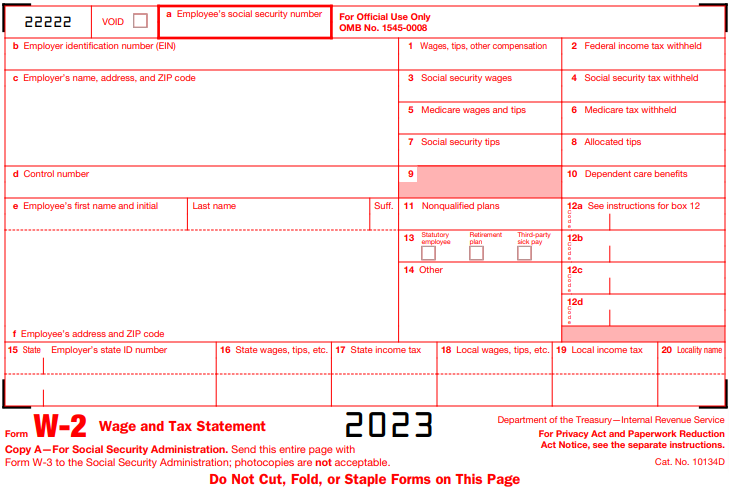

Form W-2

Like most other states, the state of Illinois requires you to file Form W-2 online with them. This is to provide an annual statement that includes gross wages, social security wages, and state income tax withholdings.

Form W-2c is the correction for any Form W-2 errors.

When it comes to e-filing Illinois W-2 taxes Form, Illinois state does not require any additional forms to be submitted with Form W-2.

Electronic filing is the only way to submit form W-2. The state will not accept paper filing or CD. We provide and support all the information through your Efiling process. This makes it incredibly quick and easy to complete your W-2 Illinois tax return.

Form 1099

Note: For Illinois state, you need not have to file 1099 forms. Because the State of Illinois does not require you to file Form 1099.

Due Date to File W-2 Forms for Illinois State

You need to e-file your Illinois W-2 taxes by the deadlines in order to avoid facing serious penalties.

The deadline to File Form W-2 with the State of Illinois is January 31, 2024.

Note: If the deadline falls on a weekend or federal holiday, the deadline will be on next weekday.

Advantages of e-filing

- Better accuracy

- Avoid paper works & filing errors

- Easily Organize your Records

- Receive an acknowledgment that the IRS received your return

- E-file your taxes on time to avoid penalties

- File from anywhere

- File from anywhere

Illinois State Filing Requirements

In order to complete your W-2 Illinois tax return you need to provide the following information:

- Employer details: Name, EIN, Employer code & type, and address.

- Employee's details: Employee ame, contact information, SSN, and address.

- Federal details: Federal income and federal taxes withheld.

- State filing details: State income and state taxes withheld for Illinois.

Why IllionisTaxFilings.Info is Your Best W-2 Illinois tax Solution?

We take the frustration, confusion, and guesswork out of e-filing your W-2 Illinois state tax forms by providing you with every form you need. We also don't leave you on your own as we have provided step-by-step W-2 instructions that will help you complete your forms on time. Our safe and secure system will help you transmit your Forms directly to your state department, then you will receive live status updates about them via email! And our e-filing starts at a great price!

Bulk Upload

Print Center

Postal Mailing

Steps to E-file Your W-2 Illinois Tax Returns

- Step 1: Create your free account

- Step 2: Choose Form W-2

- Step 3: Enter W-2 Information

- Step 4: Review Form W-2

- Step 5: Transmit W-2 to the SSA

Pricing starts at $0.50/form

Illinois Paystub Generator

Generate Pay Stubs for employees and contractors in Illinois. Enter the basic information of the company and employee,

our Illinois paystub generator will handle the rest like accurate tax calculations and deductions.

Get Your First Paystub for Free

Get started Now & File your Form W-2 with the State of Illinois.

Contact Us

Our amazing, US-based support team is here to help. If you need any assistance during any stage of the filing process pleasedon't

hesitate to contact us.

Phone Support: Monday - Friday from 9 AM to 6 PM EST at 704.684.4751

Email: support@taxbandits.com